georgia property tax exemption codes

State of Georgia government. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

2017 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-40.

. People who are 65 or older can get a 4000 exemption. To apply for a. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain.

Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax. State and federal government websites often end in gov. Tax exempt status of a property is not transferable by a change in ownership between two entities.

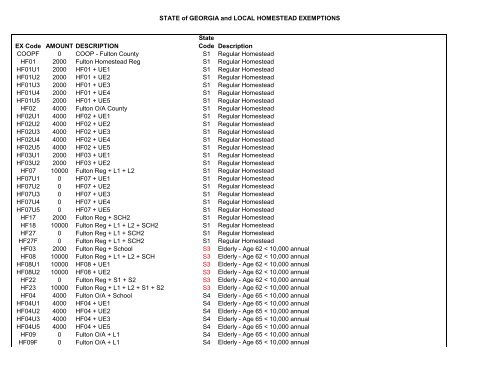

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description COOPF 0 COOP - Fulton County S1 Regular Homestead. Georgia exempts a property owner from paying property tax on. While the state sets a minimal property tax rate each county and municipality sets its own rate.

Individuals 65 Years of Age and Older. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. All tools and implements of.

If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000--. The taxes are replaced by a one. Justia US Law US Codes and Statutes Georgia Code 2021 Georgia Code Title 50 - State Government Chapter 25.

Property taxes are the cornerstone of local neighborhood budgets. Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment. Qualifying disabled veterans may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes.

In order to qualify for the exemption you must be. The Tax Digest Consolidated Summary herein referred to as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district. In Georgia property is required to be.

The additional sum is. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16. Any Georgia resident can be granted a 2000 exemption from county and school taxes.

Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. You must meet the requirements of Georgia Law for exemption under code section 48-5-41. Items of personal property used in the home if not held for sale rental or other commercial use.

2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41. Fulton County homeowners have until April 1 to apply for a homestead exemption and a discount on city county and school property taxes. The tax exemption provided for in this Code section shall include.

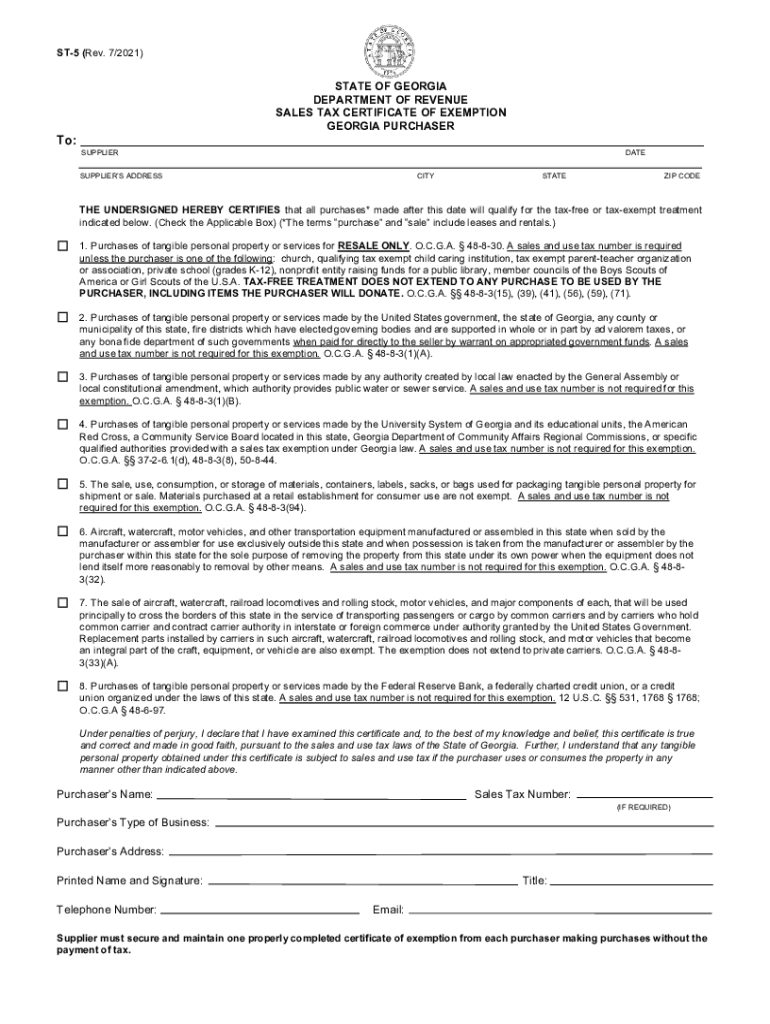

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Gsccca Org Pt 61 E Filing Help

Homestead Exemption Codes Qpublic

Newton County Assessor S Office

Property Tax Calculator Smartasset

Tangible Personal Property State Tangible Personal Property Taxes

Homestead Exemption Codes Qpublic

Exemptions To Property Taxes Pickens County Georgia Government

About Homestead Exemptions Effingham County Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Homestead Other Tax Exemptions

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Tax Comparison By State For Cross State Businesses

Exemptions To Property Taxes Pickens County Georgia Government

Filing For Homestead Exemption Garden City Ga